Try today and get your first 2 weeks FREE! Use coupon code FEBRUARY2026 at checkout.

Developed by Brea Fried, an Associate of the Society of Actuaries with over 8 Years of Actuarial Career Guidance.

The Shortcut to Passing Exams and Landing Your First Actuarial Dream Job!

Stop Wasting Time: Be Job-Ready With 2 Exams Passed in Just 1 Year

The Actuarial Exam TRAP

Why Your Dream Career Could Be Slipping Away (and How to Stop It)

Have you ever heard someone say, “I got an actuarial internship with 1 exam passed” or “I passed 2 exams and then got 3 job offers”?

It sounds great, doesn’t it?

But because of statements like these, you might have found yourself thinking:

“I’ll study as much as I can so I pass quickly—then the job offers will come.”

“I just need to pass one more exam, and then I’ll start applying.”

“Employers probably just want someone with more exams than me.”

“Other candidates have more exams than I do… I need to catch up.”

And maybe you’re even…

Studying every chance you get so that you can pass exams ASAP

Skipping networking events and putting off learning Excel because you’re going to focus on exams first

Studying for multiple exams back-to-back to get through them fast (even though you feel burnt out)

Sound familiar? Well…

Here’s the truth that most people won’t tell you.

Even though you’ve heard so many people make statements like “I got a $70K actuarial job with 1 exam passed”, you’re probably not going to get the same result just by passing some exams.

That’s because these statements are SURFACE LEVEL.

They only tell you about the exams.

They don’t tell you what’s below the iceberg — All the other qualifications, the network, the resume & interview skills that got these future actuaries to success.

Since these types of statements are so prevalent on Reddit, YouTube, and everywhere else that you go for information, it seems like passing exams is what gets you the job.

However, in my experience working with 100s of future actuaries and talking to multiple actuarial recruiters, I’ve learned that…

Exams are the expectation. Not the differentiation.

That’s right…

These days, actuarial recruiters ASSUME that candidates are going to have at least one exam passed. If not, then it’s unlikely that they’ll be seriously considered for the job.

So, if you want to differentiate yourself from the 100s of other applicants, you can’t put all your eggs in one basket.

You’ve got to balance your time between studying for exams and strengthening other key qualifications.

This is where most future actuaries go wrong and it derails their actuarial career without them even knowing.

The Harsh Reality of Continuing Like This

If someone like you goes down this path where exams are the one-and-only priority, here’s what often awaits them after 6-12 months of hard-core studying.

They feel invisible despite passing multiple exams—sending out applications but hearing nothing back.

They wonder if they made a mistake choosing actuarial science because the job search is much harder than expected.

They feel pressure from family & friends who don’t understand why they haven’t got a job yet.

They doubt if they’re even “good enough” for an actuarial career.

They scramble to learn technical skills, like Excel, SQL, or Python after seeing these skills listed in so many job posts

The worst part? That they often end up either:

But Here’s the Good News…

This doesn’t have to be your future.

There’s a proven pathway to actuarial success—one that combines strategic exam prep with the development of key qualifications that actuarial recruiters are almost always looking for.

It’s more of a holistic approach to building your career, so that you can become a top candidate that recruiters are excited to hire.

Curious to learn more?

Well, let me introduce you to…

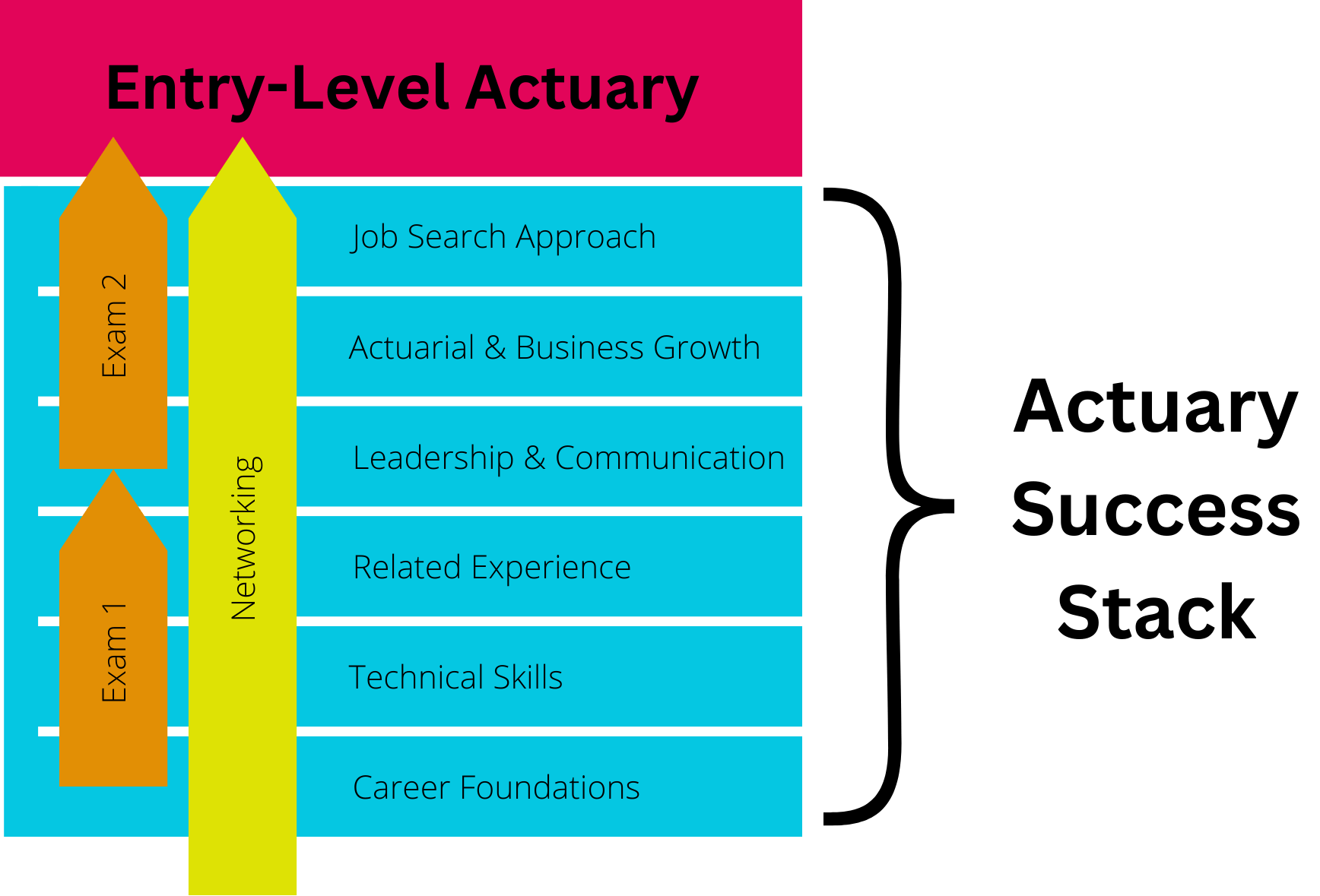

The Study & Stack System

The Study & Stack System is a step-by-step roadmap that helps you study smarter while also building the other qualifications that you need to become a top candidate and get your first actuarial job (or internship).

Instead of spending a year grinding exams only to struggle with job applications later, you’ll prepare for exams AND stack up the exact skills, experience, and connections that get you hired (aka your “Success Stack”).

With this system, you:

Pass exams with less studying using a proven study strategy & expert support

Gain job-ready actuarial skills (like Excel, programming, and industry knowledge)

Get experience through projects and related jobs so your resume stands out

Avoid common mistakes that often leave future actuaries jobless even after passing multiple exams

Should you start this NOW or LATER?

Think of the Study & Stack System like this…

Suppose you want to make tomato sauce for the Actuary Tomato Sauce competition.

You need to grow tomatoes and zucchini for the sauce ingredients and you need them by the end of August.

Would you…

A) Plant the tomatoes first, wait until they’re done, then plant the zucchini?

B) Plant both at the same time, so that they’re both ready by August?

Option B? Yes!

If you use option A, you’ll have tomatoes ready in June (2 months before the competition) and they’ll be rotting by competition time. Plus, you’ll have tiny, bitter zucchini that haven’t had time to grow.

Make sense?

Now, think of this…

If you wait until after exams to build your Success Stack, it won’t be strong enough by the time you start looking for a job. (It’ll be a tiny, bitter zucchini.)

But if you start both now, you’ll have exams and a job-ready Success Stack by the time you’re ready to start your job search.

So should you start now? Definitely, YES!

Don’t think you have time for this?

That’s totally fair—especially if your top priority is passing your exam as soon as possible.

But here’s the truth: passing exams isn’t your big picture goal.

Your BIG PICTURE goal is to get an actuarial job.

And if you wait to build your Success Stack until after your exams, you’re actually slowing yourself down.

With the Study & Stack Strategy, your exam progress might be a bit slower—but you’re building your Success Stack at the same time.

So by the time you’ve passed 2 exams, you’re already a top candidate—job-ready, not just exam-ready.

It’s the faster path to your real goal and your future self will thank you for starting now.

How Do You Get Started?

Once you become a top candidate, getting an actuarial job is inevitable.

I’ve seen it happen again and again and AGAIN!

So, do you want similar results?

Ready to learn where how YOU can follow the Study & Stack Strategy?

Well…

Let me introduce you to…

The Actuary Accelerator Community!

From Exam Prep to Job Offer—Faster.

Create THE PERFECT STUDY STRATEGY with our Ultimate Study Blueprint, with 3 core phases that support you in fitting studying seamlessly into your lifestyle—don’t sacrifice your life for studying!

Build YOUR SUCCESS STACK from the ground up, with no previous experience or knowledge required. Differentiate yourself from the competition by focusing on job-ready skills and a network full of potential.

Master ESSENTIAL TECHNICAL SKILLS through our Excel & Programming Courses, complete with 10+ hands-on actuarial projects that enhance your resume and prepare you for your first job.

Get access to EXPERT MENTORSHIP with 2 monthly group coaching calls focused on your study strategy, your Success Stack and resume critiques, ensuring you have the support and guidance you need every step of the way!

Join a THRIVING COMMUNITY OF FUTURE ACTUARIES for motivation and accountability, where you can connect with other future actuaries who understand your journey and share valuable insights and experiences!

Experience PERSONALIZED SUPPORT with 2 one-on-one tutoring sessions each month, giving you tailored feedback and guidance to help you overcome challenges and stay on track!

TRANSFORM YOUR CAREER POTENTIAL with our exclusive bonuses, including the Exam P and FM Instant Support Network, Ultimate Student Success Guide, and Career-Changer Success Blueprint—worth over $200!

This is your chance to reach your true potential in the actuarial career!

Join the Actuary Accelerator Community today and take the first step towards becoming a TOP CANDIDATE and getting your DREAM JOB!

The 3 Key Pillars Breakdown

Pillar A: Exam P & FM Study Support

💡 We Don’t Reinvent Study Materials—We Fill the Gaps They Leave Behind

There are already tons of high-quality study materials out there, so we haven’t spent time recreating what already exists.

Instead, we’ve built everything else future actuaries usually don’t get when they sit down to study:

✅ Gain the Ultimate Study Blueprint – A roadmap to strategically passing your exam even if you don’t have hundreds of hours to study each month.

✅ Learn Study Tips from Successful Candidates – Learn what strategies worked for others, giving you insider knowledge that can significantly boost your chances of passing.

✅ Uncover Time Management Hacks – Discover how to balance your studies with your personal life, ensuring you achieve your goals without sacrificing your well-being.

✅ Study Smarter through Live Sessions With Brea – Connect with Brea and other exam takers to maximize your efficiency and solidify your strategy

✅ Access Personal and Group Tutoring Sessions – Get clarity on exam topics and questions that you’re struggling with leading up to exam day

✅ And MORE!

We help you select the best study materials for you, then show you how to use them the best way, with the structure, accountability, and guidance that actually leads to exam success.

Pillar B: Building Up Your Qualifications

🎯 Your Success Stack is Your Competitive Edge in the Actuarial World

Passing exams is only one part of becoming a top actuarial candidate. If you want to actually land the job, you need to build the full package—and that’s what this part of the program is all about.

Through step-by-step guided lessons, you’ll be able to stack valuable skills and experiences that set you apart from the competition (all while you’re studying for exams).

✅ Master Excel and foundational programming — build technical confidence and capability.

✅ Complete hands-on practice projects — so you have real actuarial-style projects to put on your resume and talk about during interviews.

✅ Gain related experience — including potential opportunities for actuarial-adjacent work and internships to help you get your first job.

✅ Develop leadership and communication skills — to thrive in collaborative, analytical environments.

✅ Create a tailored actuarial resume — that gets noticed and avoids being overlooked.

✅ Learn actuarial terminology and professional expectations — so you walk into interviews already speaking the language.

Becoming a top candidate isn’t just about passing exams. It’s about building your full Success Stack — so you’re not only ready to get hired, but you’re also ready to succeed once you start working.

Pillar C: Make Connections

🤝 Strategic Networking Support: Land the Job You Actually Want

Getting a job is great — but getting your dream actuarial job at a company you love? That’s what we’re here to help you do.

Our targeted networking support flips the usual “apply everywhere and hope” approach on its head. Instead, we’ll help you build a customized Networking Map so you can identify and connect with companies that align with your goals, values, and interests — even before they’re hiring.

(Psst, this works even if you don’t know a single actuary yet.)

✅ Create a Networking Map that helps you focus on the right companies, not just the available ones.

✅ Get connected with professionals in the industry who can support and guide your journey — not just now, but years from now.

✅ Learn how to network on LinkedIn — including exactly what to say and how to say it (even if you’re introverted or just getting started).

✅ Start building relationships early so you’re not scrambling when it’s time to job hunt.

✅ Let your network know you’re becoming an actuary — and how they can support you along the way.

AND MORE!

This isn’t about networking when you’re desperate for a job. It’s about planting the seeds early, building genuine connections, and putting yourself in the best position to say yes when the right opportunity comes your way.

Because you don’t just want any job. You want the right job — and your network can help you get there.

I also loved the Job Search Phase modules, they gave actionable advice on writing a resume, cover letter, and LinkedIn profile. I was really impressed with the ‘How to Network Effectively on LinkedIn’ module. The knowledge I got from the Job Search Phase can easily be applied to any career, so if you’re contemplating an actuarial career the AAC is well worth trying out.

— Samantha H.

Start Building Your Success Stack Today!

You Can Do This Too! Just Like Our Past Members..

“I Got a Job Within 2 Months, When I Had Been Searching For 5 Months Before That”

Dean decided that his teaching career wasn’t what he thought it would be, so he switched into the actuarial career and hasn’t looked back!

“I’m Working as an Actuarial Consultant Now, Making a Bit Over $60K Per Year!”

Emma became a top actuarial candidate in less than a year, and just recently got her first full-time job in pension consulting!

Here’s What Other Successful Members Have Said…

Start Becoming a Top Candidate Today!

Select the membership option that works best for you!

AAC Only

Most Popular- Strategic exam study support

- Personalized coaching and accountability

- Hands-on technical skill building

- Professional networking made easy

- Career-ready resume and guidance

- Supportive future actuary community

- 2 one-on-one coaching calls with Brea (30 minute, use anytime you'd like)

Lifetime AAC Access

With Direct Access to Brea!- Strategic exam study support

- Personalized coaching and accountability

- Hands-on technical skill building

- Professional networking made easy

- Career-ready resume and guidance

- Supportive future actuary community

- 2 one-on-one coaching calls with Brea (30 minute, use anytime you'd like)

Check Out These Limited-Time Bonuses!

Right now, you can get access to over $200 in extra bonuses right away when you join!

What’s more? You get to keep access to the bonuses forever!

Exam P and FM Instant Support Network ($100)

Feeling alone in your study journey? Not anymore! Our exclusive WhatsApp Study Groups are your lifeline to instant motivation, real-time support, and collaborative learning.

Ultimate Student 🎓 Success Guide ($67)

Worried about fitting this program into your busy student life? This comprehensive PDF is your personal roadmap to mastering the Study & Stack system, specifically tailored for students who are juggling multiple responsibilities.

Career-Changer Success Blueprint ($67)

Doubting if you can break into the actuarial field? This guide is your proof that it’s never too late to pursue your dream career. Packed with inspiring success stories and strategic advice, this PDF will shatter your limiting beliefs and show you exactly how to transition into the actuarial world.

Put in the Work, Get Your Actuarial Job –

Or Your Money Back!

We love working with people who are serious about this journey—future actuaries who are ready to put in the effort and actually go for it. That’s why we’ve got your back with an 18-month guarantee.

Here’s how it works:

If you don’t land an actuarial job within 18 months, we’ll refund your full investment—as long as you’ve been showing up and doing the work. That means things like:

- Participating in coaching calls at least once per month

- Finishing 4 of our Excel + programming projects

- Using the Study & Stack system to become a top candidate

- Joining in on at least 1 community challenge

- And showing that you’ve been actively applying to jobs for at least 3 months after finishing the Study & Stack system

You don’t need to be perfect. But if you can show that you’ve been consistently giving it your best shot, and you’re still not seeing results—we’ll make it right.

This isn’t just a course. It’s a proven path. And this guarantee is our way of saying: we believe in what we teach, and we believe in you. If you go all-in and it doesn’t work, we’ll give you every penny back.

Refund Details:

⏳ Timeframe: 18 months

✅ Requirement: Proof you’ve been a top candidate for 3+ months (projects, job apps, calls, challenges, etc.) and applying for 30+ jobs during that time period

📩 How to request: Email support@etchedactuarial.com

👋 Who you’ll hear from: Brea or Crystal

If you’re ready to go for it—we’re ready to support you every step of the way. Click the button below and let’s start building your actuarial career for real.

How much do you need to invest?

At this point, you’re probably wondering, “How much is this going to cost me?”

I get it.

Most future actuaries immediately jump to the price. But, what if I told you that the Actuary Accelerator Community is so much more than just another expense?

This is an investment into yourself and your future career – a path that could set you up for a $60,000 (or much more) salary to start in the actuarial field (and it goes way up from there).

Now, I want to be transparent.

Some future actuaries choose to go back to school and get a master’s degree in actuarial science, which can cost anywhere from $15,000 to $50,000. That’s thousands of dollars just trying to break into the career.

My 1-hour coaching calls typically cost $250.

But instead of charging thousands for limited access, I’ve designed this program to give you access to everything I know about becoming a top actuarial candidate and getting your first job or internship.

That way, you get targeted, practical guidance for wayyyy less.

This isn’t just information thrown at you – it’s a comprehensive roadmap to your success.

So here’s how this works – You can access this entire program for just $99 per month.

Or, if you’re ready to commit to your future, you can get lifetime access for just $999!

That’s less than the cost of a single semester of traditional education, but with a laser-focused approach to launching your actuarial career.

This isn’t just an expense – it’s an investment in your future. You’re securing a pathway to a confident, successful start in a career that can pay $60,000 or more right out of the gate.

The real question isn’t “Can I afford this?” – it’s “Can I afford to miss this opportunity?”

🎉 SO, LET’S RECAP!

Here’s everything you get when you join the Actuary Accelerator Community today:

All the Exam Prep Support You Need (to complement your study materials)

You’ll follow a proven path to help you pass your first two actuarial exams (Exam P and FM), without the overwhelm. We don’t just tell you to study — we show you how to study, when to shift gears, and how to stay consistent, even when life gets busy.

(Value: $800 for 2 exams)

Success Stack Plan & Networking Approach

You’ll get a step-by-step system to build all the qualifications you need to stand out from other candidates. Plus, a proven approach to networking so that you can get your actuarial dream job.

(Value: $500)

Excel & Programming Skills – with Real Projects

You’ll learn the technical tools future actuaries need — like Excel, VBA, and Python — through beginner-friendly lessons and resume-worthy projects you can talk about in interviews with confidence.

(Value: $200)

2 Monthly Group Mentorship Sessions

Join live sessions with Brea Fried, Associate of the Society of Actuaries, where we dig into study strategy, exam mindsets, resume critiques, and what it really takes to succeed in this journey.

(Value: $1,500 over 12 months)

Group and 1-on-1 Tutoring Sessions Every Month

You won’t get lost in the crowd. With personalized support, you’ll get direct guidance to help you overcome obstacles, fix weak areas, and build real momentum.

(Value: $1,000 over 12 months)

Supportive Peer Community

You’re not doing this alone. Surround yourself with other ambitious future actuaries who get it, and who can keep you motivated and accountable — no matter where you are in your journey.

(Value: $500 over 12 months)

18-Month Success Guarantee

If you put in the effort and follow the program — and you don’t land an actuarial job within 18 months — we’ll refund your investment. We believe in what we teach, and we stand behind it.

(Value: Priceless)

💥 AND YOU’RE GETTING THESE EXCLUSIVE BONUSES — FREE:

🎁 Exam P & FM Instant Support Network

Get access to private WhatsApp study groups so you’re always one message away from encouragement, accountability, or quick help.

(Value: $100 over 12 months)

🎁 Ultimate Student Success Guide

Busy student? This roadmap walks you through exactly how to use the Study & Stack system effectively alongside classes or other commitments.

(Value: $70)

🎁 Career-Changer Success Blueprint

Transitioning into actuarial from another field? This guide will help you shift gears with clarity and position your experience to your advantage.

(Value: $70)

You’re not just joining a program — you’re gaining a strategy, a support system, and a stack of qualifications that puts you ahead of the competition and on the path to your dream actuarial job.

THAT MAKES EVERYTHING YOU GET WORTH WELL OVER $4,700!

But you’re not paying anywhere near that today! You can get started for just $99 today and gain instant access to everything above.

Join now and start your journey towards becoming a confident, job-ready actuarial candidate today!

Are You Going to Invest in Your Future?

So now, it’s time for you to make a choice.

You have two options in front of you:

🔴 Choice #1: Try to figure out how to become a top candidate and build your success stack on your own—hoping that the trial and error method works and that you don’t waste a ton of time.

🟢 Choice #2: Commit to going all in, invest in yourself, and take a proven path to transform your actuarial future.

Start Becoming a Top Candidate Today!

Select the membership option that works best for you!

AAC Only

Most Popular- Strategic exam study support

- Personalized coaching and accountability

- Hands-on technical skill building

- Professional networking made easy

- Career-ready resume and guidance

- Supportive future actuary community

- 2 one-on-one coaching calls with Brea (30 minute, use anytime you'd like)

Lifetime AAC Access

With Direct Access to Brea!- Strategic exam study support

- Personalized coaching and accountability

- Hands-on technical skill building

- Professional networking made easy

- Career-ready resume and guidance

- Supportive future actuary community

- 2 one-on-one coaching calls with Brea (30 minute, use anytime you'd like)

EVERY EFFORT HAS BEEN MADE TO ACCURATELY REPRESENT OUR PRODUCTS AND THEIR POTENTIAL. THERE IS NO GUARANTEE THAT YOU WILL EARN ANY MONEY USING THE TECHNIQUES AND IDEAS IN THESE MATERIALS. EXAMPLES IN THESE MATERIALS ARE NOT TO BE INTERPRETED AS A PROMISE OR GUARANTEE OF EARNINGS. EARNING POTENTIAL IS ENTIRELY DEPENDENT ON THE PERSON USING OUR PRODUCTS, IDEAS, AND TECHNIQUES. WE DO NOT PURPORT ANY OF OUR PRODUCTS TO BE A “GET RICH SCHEME.”

ANY CLAIMS MADE OF ACTUAL EARNINGS OR EXAMPLES OF ACTUAL RESULTS CAN BE VERIFIED UPON REQUEST. YOUR LEVEL OF SUCCESS IN ATTAINING THE RESULTS CLAIMED IN OUR MATERIALS DEPENDS ON THE TIME YOU DEVOTE TO OUR PROGRAMS, IDEAS, AND TECHNIQUES MENTIONED, YOUR FINANCES, KNOWLEDGE, AND VARIOUS SKILLS. SINCE THESE FACTORS DIFFER ACCORDING TO THE INDIVIDUAL, WE CANNOT GUARANTEE YOUR SUCCESS OR INCOME LEVEL, NOR ARE WE RESPONSIBLE FOR ANY OF YOUR ACTIONS.

MATERIALS IN OUR PRODUCTS AND ON OUR WEBSITE MAY CONTAIN INFORMATION THAT INCLUDES, OR IS BASED UPON, FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS GIVE OUR EXPECTATIONS OR FORECASTS OF FUTURE EVENTS. YOU CAN IDENTIFY THESE STATEMENTS BY THE FACT THAT THEY DO NOT RELATE STRICTLY TO HISTORICAL OR CURRENT FACTS. THEY USE WORDS SUCH AS “ANTICIPATE,” “ESTIMATE,” “EXPECT,” “PROJECT,” “INTEND,” “PLAN,” “BELIEVE,” AND OTHER WORDS AND TERMS OF SIMILAR MEANING IN CONNECTION WITH A DESCRIPTION OF POTENTIAL EARNINGS OR FINANCIAL PERFORMANCE.

ANY AND ALL FORWARD-LOOKING STATEMENTS HERE, OR ON ANY OF OUR SALES MATERIALS, ARE INTENDED TO EXPRESS OUR OPINION OF EARNINGS POTENTIAL AND POSSIBILITY. MANY FACTORS ARE IMPORTANT IN DETERMINING YOUR ACTUAL RESULTS AND NO GUARANTEES ARE MADE THAT YOU WILL ACHIEVE RESULTS SIMILAR TO OURS OR THE TESTIMONIALS OF OUR CUSTOMERS. IN FACT, NO GUARANTEES ARE MADE THAT YOU WILL ACHIEVE ANY RESULTS FROM THE IDEAS AND TECHNIQUES IN OUR MATERIAL.

*The above graph may not accurately represent all entry-level actuarial positions. $4000/mo is a reasonable expectation, though.

Card details not working? Go here to try.

*The above graph may not accurately represent all entry-level actuarial positions. $4000/mo is a reasonable expectation, though.

*The above graph may not accurately represent all entry-level actuarial positions. $4000/mo is a reasonable expectation, though.

Card details not working? Go here to try.

*The above graph may not accurately represent all entry-level actuarial positions. $4000/mo is a reasonable expectation, though.